What does moving insurance not cover? Learn the biggest exclusions and how to avoid expensive moving mistakes before you file a claim.

The excitement of a new home can quickly turn to heartbreak. Imagine the Calgary family who found their antique $15,000 piano structurally damaged after a cross-country move and received only $90 in compensation.

This devastating scenario is alarmingly common. The truth is, 80% of Canadians don’t properly insure their belongings during a move, operating under the dangerous assumption that the basic protection offered by their mover is comprehensive. This gap between perception and reality can lead to devastating financial loss without proper coverage.

We promise a different outcome for you. This guide provides a comprehensive breakdown of what Canadian moving insurance does NOT cover, helping you identify critical coverage gaps before they cost you thousands.

We will clarify the difference between valuation and insurance, detail the 12 major exclusions you must know about, and reveal the surprising limitations of your homeowner’s insurance.

Read on to secure your next move.

How Moving Insurance Works In Canada

Before we dig into what’s NOT covered, you need to understand the biggest misconception about moving protection: most people don’t actually purchase true insurance at all.

The Critical Distinction: Valuation Vs. True Insurance

When you hire a moving company in Canada, you are not automatically getting an insurance policy. You are getting Valuation, which is simply the mover’s maximum financial liability, required by law. It dictates how much they are legally responsible for if they damage your belongings due to their negligence.

Real Insurance, on the other hand, is a policy, often purchased separately, that provides broader coverage based on your item’s actual market value and covers a wider range of potential perils. The difference between the two concepts is often thousands of dollars in a claim payout.

Think of it this way: Valuation is the bare-bones, weight-based liability protection. Real moving insurance (like Replacement Value) is the full, comprehensive safety net.

The Basic Protection Every Canadian Mover Gets

By law, Canadian moving companies must provide basic valuation, called Released Value Protection.

- Standard Coverage: This is limited to $0.60 per pound, per article, regardless of the item’s true worth.

Your Real Protection Options In Canada

To secure adequate protection, you must purchase a higher tier:

- Declared Value Protection: You set a total maximum value for the entire shipment, often with per-item limits. Better than Released Value, but still limited.

- Replacement Value Protection (RVP): This is highly recommended. It covers the full cost to repair or replace a damaged item at today’s market price, without depreciation or per-pound calculations. It typically costs around 1% of your shipment’s value.

- Third-Party Insurance: The most comprehensive coverage, purchased from an external insurer, offering protection for high-value items and broader risks like natural disasters.

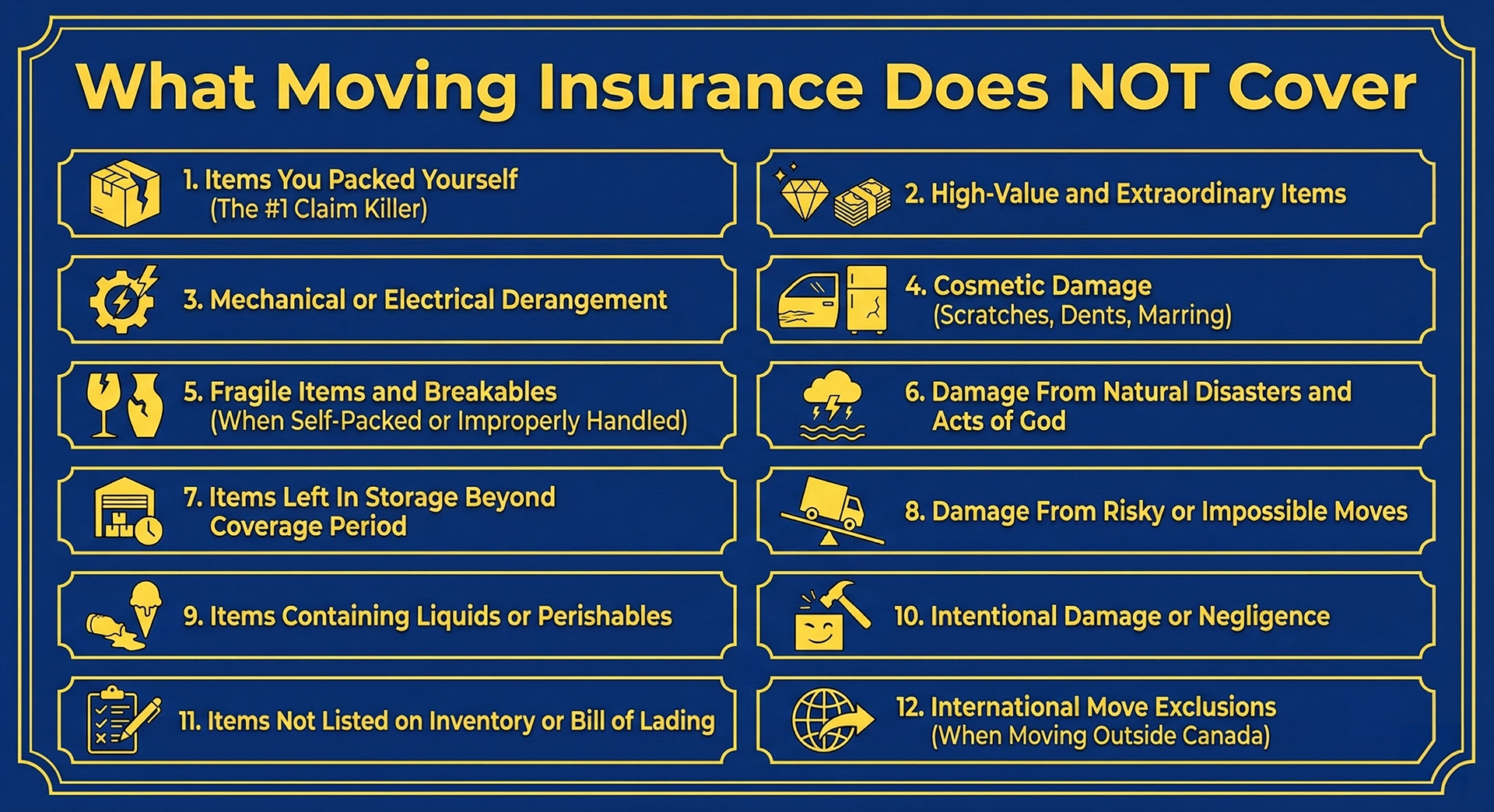

❌ The 12 Major Exclusions: What Moving Insurance Does NOT Cover

This is where people get burned. Even when you purchase “full coverage,” these exclusions apply. Read this section carefully; it provides the knowledge to save you thousands.

1. Items You Packed Yourself (The #1 Claim Killer)

This is the single biggest reason Canadian moving claims are denied. If you packed a box yourself (Owner-Packed Boxes, or PBO), and the contents inside break, the moving company will almost certainly reject the claim.

Moving companies only cover items they packed professionally. They cannot guarantee the quality of your packing materials or technique, so they won’t take responsibility for internal damage.

The Rule: If the box arrives intact but the contents are broken, the claim is rejected. Coverage only applies if there is visible external damage (e.g., the box was dropped or crushed by the movers).

How To Protect Yourself:

- Invest in professional packing for anything fragile, valuable, or difficult to replace.

- Use a hybrid approach: Pack unbreakable items yourself, but hire the pros for all fragile items (kitchen, artwork).

- Ensure the Bill of Lading clearly documents which boxes you packed versus which ones the movers packed.

2. High-Value and Extraordinary Items

Standard moving insurance policies place strict caps on compensation for specific categories of high-value goods, even with Replacement Value Protection (RVP).

What Qualifies As “Extraordinary Value”:

- Jewelry, cash, stocks, bonds, securities.

- Collectibles (coins, stamps, trading cards).

- Artwork and antiques (often limited to $\mathbf{\$5,000}$ per item).

The Exclusion: If an item’s value exceeds the policy’s per-item limit, compensation will be capped unless the item was specifically declared, appraised, and listed on a separate policy rider before the move.

Protection Strategies:

- Obtain professional appraisals before moving.

- Purchase a separate rider or floater policy specifically for declared high-value items, or secure specialized third-party insurance.

- Transport small, irreplaceable valuables (like jewelry) yourself.

3. Mechanical or Electrical Derangement

This exclusion applies when an electronic or mechanical device fails to work without any visible external damage.

The Frustrating Reality: Your TV, computer, or washing machine stops working after the move, but shows no signs of dents, cracks, or crushing. You file a claim. Claim denied.

This is called “mechanical or electrical derangement,” or concealed damage, and it is excluded from most policies. Insurers argue it is impossible to prove the damage was caused by the move rather than a pre-existing condition or internal component failure.

Common Items Affected: TVs, computers, gaming systems, refrigerators, washing machines, and musical equipment.

Protection Strategies:

- Document Functionality: Take detailed, timestamped photos or videos of all major electronics working just before the move.

- Test Immediately: Test all electronics immediately upon delivery. Report any failure instantly, as most policies require notification within 24–48 hours.

- Use original manufacturer packaging if possible, or request specialized TV boxes and extra padding.

4. Cosmetic Damage (Scratches, Dents, Marring)

Moving insurance typically does not cover minor cosmetic damage unless it is directly linked to major structural failure.

The Exclusion: This covers surface scratches on wood, small dents, light scuff marks on leather, and marring. These are considered “normal wear and tear” associated with transporting heavy furniture through doorways and up/down stairs.

Why This Is Controversial: While the item remains functional (a scratched table still works as a table), the damage can be devastating to the owner.

Protection Strategies:

- Set realistic expectations: some minor wear is almost inevitable when moving heavy items.

- Photograph every angle of your furniture before the move to distinguish new damage from pre-existing conditions.

- Request additional padding and furniture blankets for valuable pieces.

5. Fragile Items and Breakables (When Self-Packed or Improperly Handled)

Coverage for fragile items like glass, crystal, china, mirrors, and lamps is conditional on who packed them and how they were packed.

Conditions That Void Coverage:

- The items were packed by the owner (PBO).

- The mover used improper materials (e.g., regular boxes instead of dish-pack boxes).

- The items were not clearly labeled as “FRAGILE.”

Canadian Climate: Fragile items risk damage from extreme temperature changes during winter moves or moisture damage during rain/snow events, especially if improperly wrapped.

Best Practices: Professional packing is non-negotiable if you want insurance coverage for fragile items. For valuable artwork, ensure custom crating is purchased.

6. Damage From Natural Disasters and Acts of God

Standard moving insurance policies typically exclude damage caused by catastrophic, uncontrollable natural events.

The Exclusion: This includes:

- Earthquakes (relevant in BC).

- Floods, severe storms, tornadoes (Prairies).

- Wildfires and resulting smoke/fire damage (Alberta/BC).

Why It’s Excluded: The potential for catastrophic loss is too high for a standard moving policy to absorb. These low-probability, high-impact events are generally covered by separate, specialized insurance markets.

Coverage Alternatives: Comprehensive third-party policies sometimes include Natural Disaster riders, which must be purchased separately. Review your homeowner’s policy, but do not rely on it as your primary defence.

7. Items Left In Storage Beyond Coverage Period

Moving insurance coverage is almost always time-limited, particularly when your belongings are placed in storage during transit.

The Lapse: Typical coverage limits for items in storage are between 30 to 90 days. If your move is delayed and your belongings remain in the storage facility past the policy’s specified end date, the coverage will lapse, and any subsequent damage (theft, water damage, or mold) will not be compensated.

Critical Questions to Ask: “What is the exact end date of the storage coverage?” and “What is the cost to purchase a storage extension?”

Protection Strategies: Purchase a separate storage insurance policy or a storage extension rider from the mover or a third-party provider if your items will be stored for longer than the standard 90 days.

8. Damage From Risky or Impossible Moves

This exclusion covers damage that occurs when you insist the movers attempt something they deem unreasonably difficult or “impracticable.”

The “Impracticable” Clause: Movers have the right to refuse to move items they deem too risky (e.g., oversized furniture up a steep, narrow Victorian staircase, or items requiring specialized crane rigging).

The Risk Transfer: If you push the movers beyond their professional judgment, they will ask you to sign a waiver. By signing, you acknowledge the risk and limit or eliminate the moving company’s liability and your insurance coverage for that specific item during that manoeuvre.

How to Protect Yourself: Get an in-home assessment before moving day to discuss any challenging access points. If an item is deemed too risky to move safely, consider selling and replacing it.

9. Items Containing Liquids or Perishables

Moving policies strictly exclude coverage for liquids and perishable items due to the high risk of contamination and damage to other goods.

Strictly Excluded Items: All food (frozen, refrigerated, pantry), live plants, paint cans, cleaning supplies, and appliances containing water (e.g., un-drained waterbeds).

The Risk: If an excluded liquid spills, not only is the liquid itself not covered, but your claim for damage caused to other belongings (furniture, clothing) by the contaminant may also be denied.

What You Must Do: Appliances must be drained and dried 24–48 hours before the move. Dispose of all perishable foods and remove all liquids and cleaning supplies before the movers arrive.

10. Intentional Damage or Negligence

This exclusion covers damage caused by the homeowner or anyone in the household, meaning damage not caused by the moving company or its employees.

Coverage Voids:

- Damage caused while you were “helping” the movers carry heavy items.

- Items damaged while in your possession after the delivery receipt was signed.

- Damage caused by your improper disassembly or reassembly of furniture.

Chain of Custody: When you assist the movers, you break the official “chain of custody,” allowing the insurer to argue that the damage was due to your own negligence rather than the mover’s.

How to Protect Yourself: Do not assist the movers with carrying or lifting heavy items. Let the professionals execute the entire move to maintain their full liability.

11. Items Not Listed on Inventory or Bill of Lading

If an item is damaged and it is not documented on the official moving paperwork, it is considered non-existent by the insurer.

The Paperwork Problem: The insurance value (and premium) is calculated based on the declared inventory. If you “forget” to list a high-value item, you have zero recourse if it is damaged. Claiming for an undeclared item can lead to an accusation of fraud.

Best Practice: Ensure a complete, itemized, and accurately valued inventory is created before moving day. Both you and the mover must sign and keep copies of the final, complete Bill of Lading and Inventory.

12. International Move Exclusions (When Moving Outside Canada)

If you are moving from Canada to the US or overseas, your standard Canadian moving insurance typically ceases to apply once the goods leave the country.

The Exclusion: Standard RVP/Replacement Value policies do not cover international risks, including:

- Customs seizures or delays.

- Import law violations.

- Damage from war, terrorism, or piracy (for sea freight).

Special Requirements: International moves demand Marine Cargo Insurance for ocean freight, and professional packing is often mandatory (not optional) for coverage eligibility. Do not rely on your Canadian domestic policy for cross-border moves.

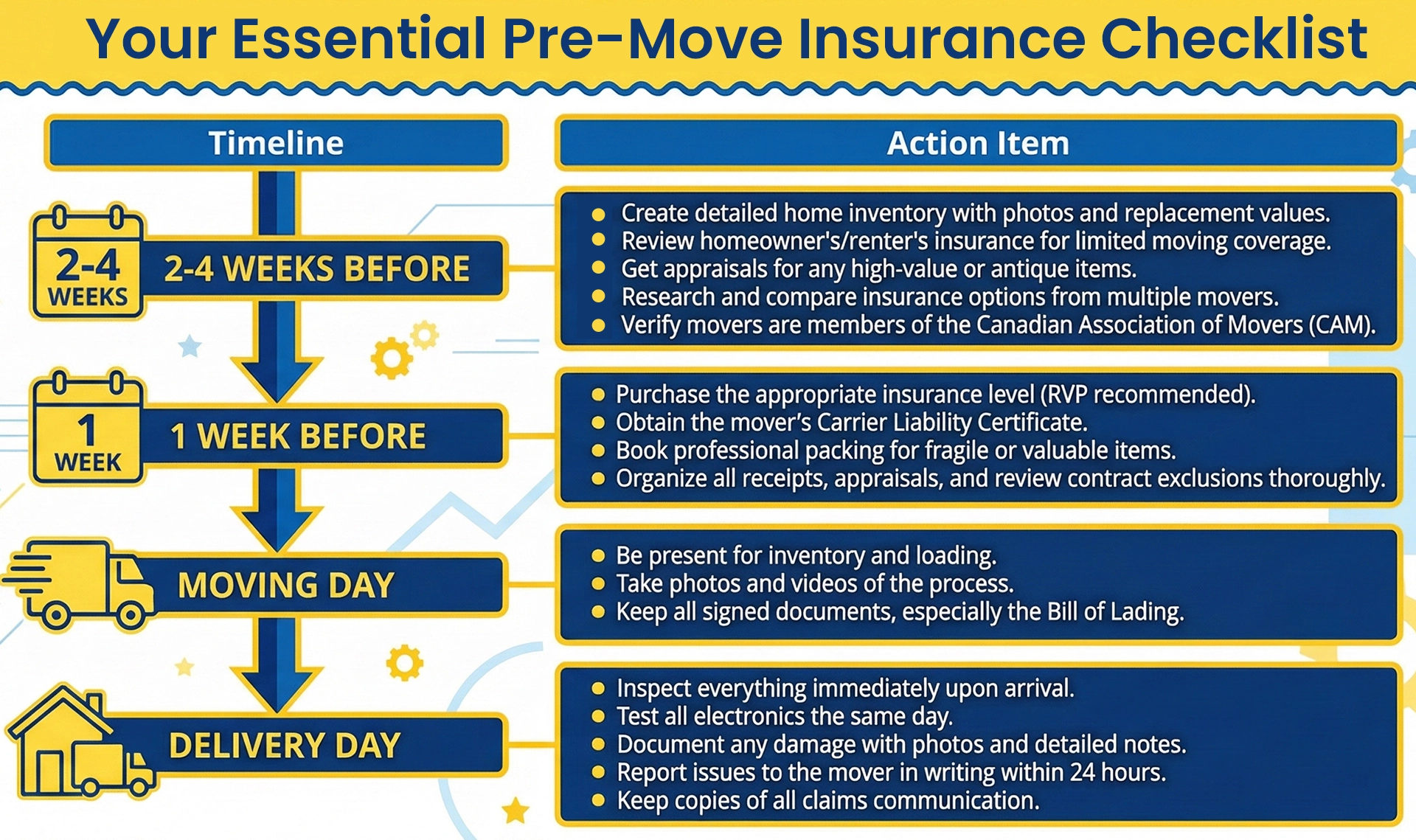

✅ Your Moving Insurance Protection Checklist

The central takeaway from reviewing these significant exclusions is simple: go for premium coverage. The gap between a mover’s minimal liability (valuation) and proper Replacement Value Protection is the difference between an unfortunate accident and a devastating financial loss. Investing in proper coverage and professional packing for high-risk items is not an optional expense it is crucial protection.

Use this actionable checklist to close the coverage gaps before moving day:

Final Thoughts

Moving insurance isn’t about paranoia; it’s about preparation. Understanding exclusions helps you make informed decisions and ensures that the financial and sentimental value of your belongings is preserved. The small investment in robust coverage and thorough documentation is the best defence against a costly mistake.

Don’t wait until damage occurs to understand your coverage. Protect your move today.

Moving Insurance Frequently Asked Question

Q1: Does My Home Insurance Cover Me When I Move In Canada?

Your home insurance offers limited coverage for belongings while in transit and may be voided if you don’t notify your insurer before moving.

Q2: What’s The Difference Between Moving Insurance and Valuation?

Moving insurance is an actual policy from an insurer, while valuation is the mover’s legal liability for damage they cause, not a true insurance policy.

Q3: How Much Does Moving Insurance Cost In Canada?

Full Value Protection from a mover typically costs about one to two percent of your shipment’s declared value; basic coverage is minimal and free.

Q4: Will My Moving Insurance Cover Items I Packed Myself?

Moving companies’ valuation often excludes items you pack yourself, as proving their negligence is very difficult; third-party insurance may differ.

Q5: Are There Items That Moving Insurance Never Covers?

Most policies and mover valuations exclude cash, jewelry, important documents, collectibles, and perishable goods unless they are expressly declared and covered.

Q6: How Long Do I Have To File A Claim After My Move?

The claim filing deadline varies widely by policy or mover, but it is typically a short window, often between 60 to 90 days after delivery.

Q7: Should I Buy Insurance From My Mover Or A Third Party?

Mover valuation is often basic and limited; third-party insurance usually offers more comprehensive coverage, full replacement value, and greater claim flexibility.

Q8: What Happens If My Items Are Damaged In Storage?

Your basic moving protection may not cover long-term storage damage; you often need to purchase a separate storage policy from the facility, mover, or insurer.

Q9: Can I Insure Just Specific High-Value Items?

Yes, you can declare high-value items to your mover or purchase a specific “floater” or rider from a third-party insurer for better, itemized protection.

Q10: What Should I Do If My Moving Claim Is Denied?

Review the denial letter for the reason, gather all documentation, and follow the company’s formal complaint process or contact the General Insurance OmbudService (GIO).

3 Comments

Thank you. Is dadmdge caused by water leaking from broken pipe behind walls inside the house covered?

Hey there! Moving insurance actually only covers damage to your belongings while they’re being handled or transported. Since a leaking pipe is an internal home issue, it wouldn’t be covered by us—you’d want to check with your Homeowners Insurance for that one!

Woh I like your articles, saved to bookmarks! .